- The Mandatory Provident Fund (MPF) System aims at assisting the working population of Hong Kong to accumulate retirement savings by making regular contributions. Employees (full-time or part-time) and self-employed persons aged 18 to 64, except the exempt persons, are required to participate in an MPF Scheme. To enrol in AIA MPF – Prime Value Choice, please submit the completed application form to us.

To facilitate your retirement planning, you may use MPFA's Retirement Planning Calculator to calculate:

- your retirement needs;

- your projected MPF and other retirement savings upon your retirement; and

- how much you need to save to meet your retirement needs.

- If you are an employer, you need to know your MPF obligations, including enrolling new employees, making contributions and reporting terminated employees. If you have any questions relating to your MPF obligations as an employer, please contact us. To become a participating employer of AIA MPF – Prime Value Choice, please submit the completed application form to us.

If you are an employee (full-time or part-time), both you and your employer are required to make regular MPF contributions for you, based on your "relevant income" as follows:

| Monthly Relevant Income | Mandatory Contribution Amount | |

| Employer's Contributions | Employee's Contributions | |

| Less than $7,100 | Relevant income x 5% | Not required |

| $7,100 - $30,000 | Relevant income x 5% | Relevant income x 5% |

| More than $30,000 | $1,500 | $1,500 |

- "Relevant income" refers to wages, salaries, leave pay, fees, commissions, bonuses, gratuities, perquisites or allowances, expressed in monetary terms, paid or payable by an employer to an employee, but excludes severance payments or long service payments under the Employment Ordinance.

- All mandatory contributions are immediately vested in you, except for the MPF derived from the employer's contributions for offsetting severance payments or long service payments.

If you are self-employed, you are required to make MPF contributions as follows:

| Relevant income | Self-employed Person's Contributions | |

| Annual | Monthly Average | |

| Less than $85,200 | Less than $7,100 | Not required |

| $85,200 - $360,000 | $7,100 - $30,000 | Relevant income x 5% |

| More than $360,000 | More than $30,000 | $360,000 x 5% = $18,000 per year OR $30,000 x 5% = $1,500 per year |

Whether you are an employee or self-employed, you may also consider making additional contributions (i.e. Voluntary Contributions (VC), Tax Deductible Voluntary Contributions (TVC) and Special Voluntary Contributions (SVC)) in light of your personal needs.

| How to Open an Account | Voluntary Contributions | Tax Deductible Voluntary Contributions | Special Voluntary Contributions |

| Your employer helps you open an account under the MPF scheme chosen by the company | You select your own MPF scheme and open an account on your own. (Note: some MPF schemes do not provide TVC / SVC accounts. You may check the MPF schemes which offer TVC / SVC accounts on MPFA's Trustee Service Comparative Platform) | ||

For details of different types of contributions, you may refer to the AIA MPF - Prime Value Choice MPF Scheme Brochure - Administrative Procedures Section

Upon joining the scheme, if you have not given us any investment instructions, your money will be invested under the Default Investment Strategy (DIS) automatically. For details of the DIS, you may refer to the AIA MPF – Prime Value Choice MPF Scheme Brochure - Fund Options, Investment Objectives and Policies Section.

Alternatively, you can choose to invest in the following funds:

Alternatively, you can choose to invest in the following funds:

Search Fund Option

Notes:

The management fees shown in the table above include the management fees chargeable by the fund and its underlying fund(s) only. There may be other fees and charges chargeable to the fund and its underlying fund(s) or to you. For details, please refer to the AIA MPF – Prime Value Choice MPF Scheme Brochure - Fees and Charges Section.

The management fees shown in the table above include the management fees chargeable by the fund and its underlying fund(s) only. There may be other fees and charges chargeable to the fund and its underlying fund(s) or to you. For details, please refer to the AIA MPF – Prime Value Choice MPF Scheme Brochure - Fees and Charges Section.

To help you make comparisons across different MPF funds and schemes, you may refer to the information on the MPF Fund Platform

- Investment involves risks. Please refer to the AIA MPF – Prime Value Choice MPF Scheme Brochure – Risk Section for details of the risk factors to which the funds are exposed

- A risk class is assigned to each fund with reference to a seven-point risk classification scale based on the latest fund risk indicator of the fund. A fund in a higher risk class tends to show a greater volatility of return than a low-risk class fund. Information about the latest risk class of each fund is set out in the latest fund fact sheet (FFS) of AIA MPF – Prime Value Choice

If you are an employee, you may opt to transfer your MPF derived from employee mandatory contributions in your contribution account under current employment (Original Scheme) to any other MPF schemes of your choice (New Scheme) once a year1. If your transfer involves selling your interests in a guarantee fund, please check with us the terms and conditions of this fund as failure to fulfil some qualifying conditions may cause the loss of guaranteed returns.

Your contribution account under current employment may consist of different parts of MPF derived from different sources and subject to different transfer rules, as follows:

Your contribution account under current employment may consist of different parts of MPF derived from different sources and subject to different transfer rules, as follows:

| Parts of MPF in a contribution account (i.e. Types of contributions that the MPF are derived from) |

Transfer rule | Type of account receiving the MPF |

| Contributions from current employment | ||

| Employer mandatory contributions | Not transferable | – |

| Employee mandatory contributions | Transferable once every calendar year1 | Personal account |

| Employer voluntary contributions | Subject to the governing rules of the Original Scheme | |

| Employee voluntary contributions | ||

| Contributions from former employment | ||

| Mandatory contributions transferred to the contribution account under current employment | Transferable at any time | Personal account or other contribution accounts2 |

| Voluntary contributions transferred to the contribution account under current employment | Subject to the governing rules of the Original Scheme | |

If you are a self-employed person or tax deductible voluntary contribution (TVC) account holder, you can transfer your MPF held in your MPF contribution account, personal account or TVC account to any other MPF schemes of your choice at any time.

1 Unless the governing rules of the Original Scheme provide for more frequent transfer-out.

2 Only applies to employees with two or more contribution accounts. If an employee is employed by more than one employer at the same time, he/she may have more than one contribution account.

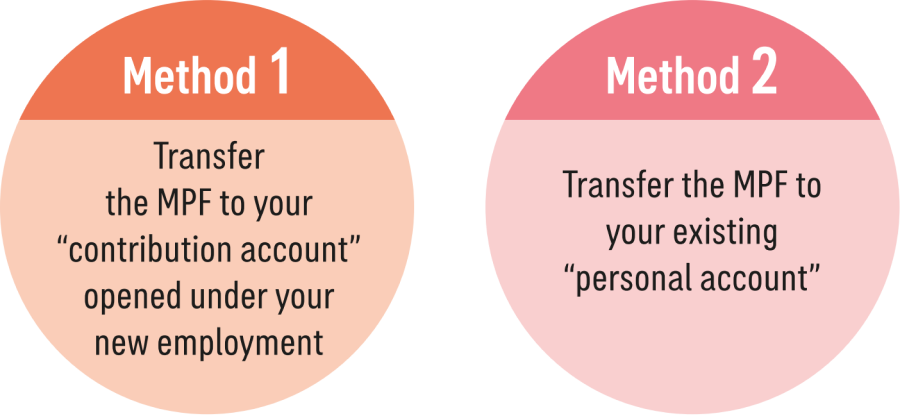

- You should proactively manage the MPF accumulated during your previous employment in one of the following ways:

- If you do not have any personal accounts, and you are satisfied with the MPF scheme chosen by your former employer, you may consider retaining your MPF in a personal account under the scheme of your previous employment for investment.

In general, it is a good practice to review your fund choices regularly and adjust your MPF fund choices as you think fit.

How to adjust your MPF fund choices?

- You may complete and submit a new investment instruction form to us. If your new investment instructions involve selling your interests in the Guaranteed Portfolio under AIA MPF – Prime Value Choice, please check with us the terms and conditions of this fund as failure to fulfil some qualifying conditions may cause the loss of guaranteed returns.

- You may send your new investment instructions to us by post/courier, fax, or through our company's AIA+ mobile app, website or interactive voice response system.

- In order that your instructions can be processed within the same day, you must send us the completed investment instructions before the cut-off time. For details, please refer to the AIA MPF – Prime Value Choice MPF Scheme Brochure

Number of investment instruction submission(s) permitted in each scheme year:

- There is no limit on the number of submissions via AIA+ mobile app; mobile app, this website or interactive voice response system (except for Guaranteed Portfolio). One switch out of the Guaranteed Portfolio to other funds is permitted in each scheme year.

- There is no limit on the number of submissions via investment instruction form (in person, by post/courier or by fax) (except for Guaranteed Portfolio), subject to any alternate arrangements agreed to by the scheme sponsor and the employer. In any case, you will have at least one opportunity in each scheme year to submit your investment instruction. One switch out of the Guaranteed Portfolio to other funds is permitted in each scheme year.

- Once you reach the age of 65, you can choose one of the following ways to manage your MPF:

- Withdrawal by instalments

- Withdrawal in one lump sum

- Remaining in the MPF scheme for continuous investment

- By law you can withdraw your MPF early on the following six grounds:

- The law does not stipulate any deadlines for withdrawing MPF. You should consider your personal needs before making a withdrawal application. If you choose to retain all your MPF in your account, no application is required. Your MPF will continue to be invested in the fund(s) you have selected.

Additional information useful to you

Additional information useful to youTaxation

Employees are allowed to claim salaries tax deduction for their mandatory contributions, subject to a maximum deduction of $18,000 per year. Contributions that are made to TVC accounts may also be eligible for tax deduction. We recommend that you seek professional advice regarding your own tax circumstances.

Documents from us

Scheme members will receive the following documents:

- Upon joining the scheme: the KSID, the MPF Scheme Brochure and the Notice of Participation; and

- Within three months after the scheme year end: the Annual Benefit Statement.

Other information

- The KSID only provides a summary of the key features of AIA MPF – Prime Value Choice. For details of AIA MPF – Prime Value Choice, please refer to the Master Trust Deed and the AIA MPF – Prime Value Choice MPF Scheme Brochure

- The On-going Cost Illustrations for AIA MPF – Prime Value Choice, a document which illustrates the on-going costs on contributions to constituent funds in AIA MPF – Prime Value Choice

- The Fund Fact Sheet provide basic information (e.g. fund performance) on individual funds of AIA MPF – Prime Value Choice

Personal Data Statement

To obtain the latest copy of the personal data statement, please write to the Data Protection Officer, AIA International Limited, 12/F, AIA Tower, 183 Electric Road, North Point, Hong Kong.

How to make enquiries and complaints?

How to make enquiries and complaints?If you would like to make an enquiry or a complaint, please feel free to contact us.

| Member Hotline | 2200 6288 |

| Customer Service Centre | 12/F, AIA Tower, 183 Electric Road, North Point, Hong Kong |

| Interactive Voice Response System | 2200 6288 |

| Fax number | 2565 0001 |

| Postal address | 8/F, AIA Financial Centre, 712 Prince Edward Road East, Kowloon, Hong Kong |

| Trustee's website | aia.com.hk |

Trustee: AIA Company (Trustee) Limited

Sponsor: AIA Company Limited

Scheme year end: 30 November

Number of constituent funds: 20

You should not make investment decisions based solely on this website. For details of AIA MPF - Prime Value Choice, please refer to the MPF Scheme Brochure and the Master Trust Deed