AIA Group Limited (the "Company") announces key new business indicators for the third quarter ended 30 September 2023.

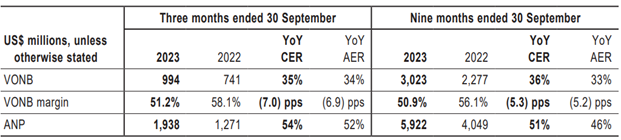

KEY FINANCIAL SUMMARY

Growth rates are shown on a constant exchange rate basis.

- Value of new business (VONB) growth of 35 per cent to US$994 million for the third quarter

- Mainland China, Hong Kong, ASEAN and India all delivered double-digit VONB growth

- Annualised new premiums (ANP) increased by 54 per cent to US$1,938 million

- Strong VONB margin of 51.2 per cent, increased from the first half of 2023