AIA Group Limited (the "Company"; stock code: 1299) announces 28 per cent growth in value of new business (VONB) on constant exchange rates (CER) for the first quarter ended 31 March 2023.

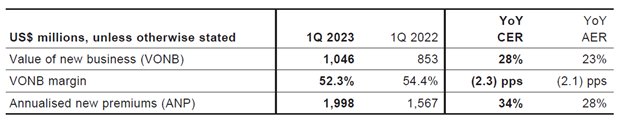

KEY FINANCIAL SUMMARY

Growth rates are shown on a constant exchange rate basis.

- VONB growth of 28 per cent to US$1,046 million

- Year-on-year VONB growth from all reportable segments

- Strong momentum from AIA China with double-digit VONB growth

- Excellent double-digit VONB growth for AIA Hong Kong

- Double-digit VONB growth in ASEAN, excellent VONB growth in India

- Annualised new premiums (ANP) increased by 34 per cent to US$1,998 million